Pretty Good Review

'Factory Man: How One Furniture Maker Battled Offshoring, Stayed Local - and Helped Save an American Town' by Beth Macy This well-written, 450-plus page book is information-packed and tells a great story ... seven stories, actually:

1. The unvarnished history of the Bassett Furniture Company - warts and all, including the various quirks, scandals and peccadilloes of various Bassett family members.

2. The tale of John Bassett III, grandson of the founder and principal character of this book, who was denied his due at the family company and left to build his own furniture manufacturing powerhouse. And later, successfully fought the Asian hardwood furniture invasion.

3. An inside look at the cutthroat furniture business - design, manufacturing, distribution and how things evolved (and devolved) over the past century.

4. The story of globalization and its insidious effects on the hardwood furniture industry which was decimated because of the influx of Asian product, coupled with the strategic missteps of American furniture executives, including the leaders of Bassett Furniture.

5. A peek at the D.C. tariff industry and the high-powered lawyers and bureaucrats who sustain it and profit from it.

6. Compelling and poignant stories of those furniture factory workers who struggled for relatively low wages and ultimately lost their jobs as manufacturing shifted to Asia. Without another place to work in the area, they were forced to move away or live at a subsistence level on welfare and odd jobs. Then there's the effect on the communities and the culture and infrastructure of various factory towns, especially Bassett, Virginia.

7. Tales of How Things Are Done in the South, including humorous catchphrases and a look at regional traditions and prejudices.

This book is about companies and people who make stuff. Manufacturing is vital to the economy of the United States because it is a generator of wealth. Ha-Joon Chang of Cambridge University has written that "production is the ultimate foundation of any economy." Taking low-cost raw materials (wood, baking flour, steel) and processing them to produce much more expensive items (furniture, cakes, automobiles) creates profit. This in turn produces prosperity - for individuals and for a nation.

Furthermore, if the nation's products are unique and interesting enough that people in other countries want to buy them, fresh capital is brought into the United States. Such capital can used to expand capacity, improve product offerings and increase efficiency - these things make our wares even more competitive and attractive in the world market.

America progressed from a dependent colony to a powerful independent nation because it took advantage of the Industrial Revolution and became self-sufficient. This land not only grew its own cotton; it added value by having all those 19th Century New England mills turn it into yarn and cloth. Which was turned into even higher-value finished apparel in places like New York's Garment District.

In the early 20th Century - during the heyday of the trolley, J.G. Brill Co. of Philadelphia manufactured streetcars, exporting them to such locations as England, Norway, India, South Africa, Finland, Australia, New Zealand, Japan, the Philippines, Chile, Peru, Venezuela and Egypt.

In 1953, more locomotives and rail cars were produced in Pennsylvania than anywhere else on earth. In the 1950s, iron and steel were the biggest industries in the state, followed by industrial and electrical machinery (think of Westinghouse making all those electrical transformers used worldwide). Also mentioned were shipbuilding, hatmaking, textiles and the brewing of beer.

Today, Pennsylvania's largest employer is Wal-Mart, followed by the U.S. Postal Service, the City of Philadelphia and the School District of Philadelphia. This is shocking and is a snapshot of what is happening in states, large and small, across the U.S.

In 1969 over one-quarter of our nation's workforce were employed in factories. By 2009, the figure had declined to 9%. Faced with ever increasing labor regulation, upwardly spiraling health care costs and the like, many companies are reducing their workforce by subcontracting - often overseas. Goodbye to high-paying, union jobs. And lower paying furniture-making jobs. Financial analyst Malcolm Berko wrote, "It wasn't long ago that big employers such as Maytag, Goodyear and General Motors paid Americans the equivalent of $40 to $60 an hour. Today many of America's largest employers - e.g., Wal-Mart and McDonald's - pay workers $8 to $12 an hour."

Sadly, the American public would rather buy on price - purchasing cheap footwear made in some Third World country from a discounter like Wal-Mart and, when a hole appears in the bottom, toss the shoes in the trash. This explains why there are almost no U.S. shoemaking plants anymore and why the number of independent footwear retailers and shoe repair shops is declining.

Reading between the lines, this book does much to explain the recent 'jobless recovery' - something which happens when you run your banking system like a dysfunctional three-card monte game, outsource all your subassemblies to Asia, close plants in Indiana and Michigan and move production to Mexico, close the tech support center in California and open one in Bangladore ... and vote for politicians who enact policies which make the aforementioned business actions the sensible thing to do.

Founded in 1902, the Bassett Furniture Company grew to become the world's biggest wood furniture manufacturer. Run by the same family for generations, it was the lifeblood of company town Bassett, Virginia. When Asian competition hit in the 1980s, Bassett responded by moving work overseas, reducing its workforce and closing plants.

In 1983, John Bassett III, a clever, driven third-generation furniture maker, broke away from the family business and went his own way. He is now chairman of Vaughan-Bassett Furniture Co., which employs more than 700 Virginians and has sales of more than $90 million. Author Beth Macy relates life Bassett's deeply personal furniture and family story, showing how he used legal maneuvers, factory efficiencies and sheer gumption to save hundreds of jobs.

You've heard tales about the abhorrent working conditions in China. This book offers several stories, including this shocker: As a Bassett Furniture vice-president, Rob Spilman visited China and toured furniture manufacturer Lacquer Craft. Rob was appalled by the "lack of safety measures in the finishing rooms - no fans, no masks, nothing. Rob actually had a fondness for the smell of finishing material, but these fumes were so strong he had trouble catching his breath. "How do they stand it," he had asked the plant manager, choking as he spoke. "Spray two years and die,' the manager replied."

Without burying the reader in numbers and charts, the author offers some startling statistics: "Between 2001 and 2012, 63,300 American factories closed their doors and five million American factory jobs went away. During the same time, China's manufacturing base ballooned to the tune of 14.1 million new jobs." The number of people receiving food stamps "tripled between 2000 and 2012, easily topping the number of newly-created jobs."

Interestingly, one of those 63,300 companies was my former company, Discovery Plastics, which perished in 2003 after its parent company was forced into a Chapter 7 liquidation bankruptcy. Interestingly, the tipping point for the parent company was the loss of J.C. Penny's business; the very same tipping point for Bassett Furniture.

The Bassett Furniture story is allegorical for business in the New America, where creative destruction runs amok and what's 'best' for us - global free trade, according to economists like Tom Friedman - may not be so good for us at all, as it pumps Wall Street at the expense of so many Main Streets - and industrial parks - throughout the land.

Verdict: A great read for anyone with an interest in manufacturing, globalization and/or the American economy and its future. Highly recommended. (posted 11/5/14, permalink)

IMO consider that investment drives production. Since the 80s investment has steadily declined.

IMO a huge part of this story is mercantilism and the willful underlying cause of offshoring due to Nixon's adopting of a baked in 2-3% inflation rate in increasing the money supply. And allowing the whole money supply thing to go on auto pilot without any intervention into Chinese mercantilism.

From contributor ja

I think I remember a Wood industry trade mag article about a Basset venture into china, involved Buying German equipment and using the US tax advantage then Closing the Sumter SC plant and some in NC in the 90s

Was that a different Basset ?

From contributor Da

Pat - Thanks for the review. Though I hardly need any convincing that this currently dominating form of American Capitalism is going to slowly (or maybe not so slowly...) bleed us dry as a nation in favor of the upward transfer of all wealth. We will look much like the South American Countries where 5% or 10% of the population controls 95% of the wealth, and 100% of the resources, as well as the government from top to bottom.

If one extends the recent trends in the changes of the middle class and the two extremes, it is only a matter of time before it is fact.

The saddest part is that as we become collectively more malleable as a people, a good many of us will be cheering this mad progression towards oligarchy, as we beat our chest and gloat about our freedoms.

Bassett may be an exception, for a period of time, but the rules are evolving so that either you play by the new rules or you.....don't play.

"Creative Destruction" is my new favorite phrase.

From contributor Ru

Pat - good read thanks for posting

Dave - always well thought out responses, I agree totally.

Happy Thanksgiving to all, especially the military folks, thanks for all you do for us!

From contributor ja

http://www.newyorker.com/business/currency/the-decline-of-an-american-furniture-ma

ker

From contributor Pa

Dave

As you know I prefer to avoid talking about politics. However, a couple of points.

The growing inequality has only one cause which is increased money printing. Inflation is not something that is equal it effects different areas of the economy differently and unevenly. The QE has increased inflation in parts of Real Estate and the Stock Market and Rodeo Drive and collectibles. It has not effected the grocery store as much. This greatly benefits the people who have access to the newly printed money. It also harms those on fixed income, those living paycheck to paycheck, those who don't have any investments.

"Creative Destruction" is great, but when it is inferred with we end up with overgrown forests, and TBTFs, which results in a diseased condition for both venues. The only healthy thing to do is allow the forest to cleanse itself of weaker trees and the economy of the weaker corporations.

From contributor Am

Pat,

What do you think contributes more to the concentration of wealth: Inflation or the Supreme Court equating corporate dollars with free speech?

Do you really think the healthiest thing for our country is to "cleanse" the weak?

From contributor Pa

Dear Amazed,

Get over it...

This is NOT about politics it is about economic facts.

The Corporate vote is irrelevant to what I'm talking about.

The mechanism is very simple and favors those who have invested in something that rises in price with inflation, inflation is brutally skewed to favor the investor and the borrower.

The very definition of inflation is to increase the money supply, this is controlled by the Federal Reserve Bank.

Which segways into the next answer which is absolutely it is best to cleanse the weak corporations. (I see you want to characterize this as cleanse Bambi, or something, which is NOT what I'm talking about)

The free market is a profit and LOSS system, which means that if you want to bet your scalp in a whiskey laden poker game, by buying ridiculously leveraged credit default swaps and something goes wrong, that is YOUR problem NOT the taxpayers.

At this point in the game Goldman Sachs, Morgan Stanley, possibly AIG, Lehman Bros, possibly GE, possibly B of A, and bunch of others would be CLEANSED. But this is how the free market works.

Similar to the forests today with years of overgrowth, too many trees do not get enough water, and are weak and diseased with pine beetles. When there is a fire it is a rager.

A big part of this process is economic calculation, this is where there is price discovery which means the real value of something is determined by market forces. An example of this would be that if all the foreclosed houses in 2009 were priced low enough to sell what would the price of those houses be. This would be price discovery of the house. But if that process is interfered with then the price is not discovered and the market recovery does occur organically but instead is driven by inorganic forces.

So the better question might be who is really getting cleansed? Because the ramifications of the above is going to effect the taxpayer for generations and severely hamper any organic economic recovery for a very long time.

From contributor Am

Pat,

There is no "free market". There never has been one. This is just a slogan. There is no omniscient "invisible hand" guiding us to the right solution.

Goldman Sachs et.al. avoided responsibility, pure & simple, because of their ability to lobby (pay off) politicians.

Do you ever wonder why these large banks can get levied bazillion dollar fines for corrupt behavior yet nobody goes to jail?

There is no free market so therefore that only leaves us politics.

From contributor Ka

The invisible hand is always there ,to pick your pocket.

From contributor Pa

If there is no free market then how did we get Google, Apple, Go Pro Cameras, Tesla Cars, Toyota, Lexus, Saw Stop Saws, CNC routers, edgebanders, an improved standard of living that allows almost everyone to be able to buy cabinets?

Sure we have a free market.

The problem is that it continues to become more and more burdened because of general economic illiteracy such as you and the majority of voters demonstrate. This allows the politicians to sell their bad ideas.

From contributor ja

Pat I respect ya , But I am not in favor of putting you in charge (humor intended)

which regulations are you wanting to remove ?

From contributor Pa

James

Not in any order and not even a modicum of a complete list, and yes some regulations are necessary. (btw your link is broke)

Repeal the17th amendment, put it back to the way the constitution had this law.

Privatize Tort law. In affect make it decided by arbitrators.

Completely dissolve the Federal department of energy.

Completely dissolve the Federal department of education.

Privatize all education.

Completely enforce the 10th amendment EXACTLY as the framers intended it and destroy any abuses of it by the federal government.

Encourage state nullification of Federal overreach. This means that if Colorado or Washington State want to make marijuana legal than the Fed has NO option to enforce rules otherwise.

Force all jury trials to make the judges enforce jury nullification of any laws they feel are unjust, as intended by the constitution.

All Federal agencies have to be judged on the merit of their contribution to their purview. E.G. OSHA would have to show that industry was made more safe by their activities, this means that technology could not count in their favor. IOW Saw Stop had nothing to do with OSHA. IOW OSHA is a pretend organization who pretends that they do something.

If banks want to practice fractional reserve lending that would be fine but the customer would vote with their feet as to which bank to keep their money at as their would be no FDIC.

I would dissolve the Federal Reserve Bank. Interest rates would be set by supply and demand without any regulation required by a government agency. This means that when savings were high, interest rates would be lower as there was a large supply of money available and higher when there was dearth of savings to lend out. Money supply is quite trivial as when the money supply is low the money would simply buy more goods. You may scoff at this but keep in mind for the first 130 some odd years this country did not have a central bank. And more to the point this country had ZERO inflation during that time. IOW you could bury a dollar in 1776 and did it up in 1913 and you could buy the exact same amount of stuff. If you buried a dollar in 1913 and dug up today you could buy 4 CENTS WORTH OF STUFF TODAY.

The only time the above was not true was during war, which brings up another point, no more wars unless they are in our direct defense. Which would require the “provocations” be scrutinized severely if you know what I mean? As more often than not the provocations are dubious.

All collective bargaining used by public employees would be illegal and any strikes would mean the employees replacement.

All subsidies would be eliminated.

BTW removing these would more than balance the budget and severely cutting the defense budget would create a budget surplus.

Oh and BTW I would back the dollar with gold just like the Swiss are deciding now.

I would eliminate the floating foreign exchange rate so that China would not be able to practice mercantilism at cost of US industry.

You might say this would cause a severe recession and at first it surely would. But consider that the worst recession in the history of the US by far and away was in 1921. Why have you never heard of it? Because it was over in 18 months and gave way to the roaring twenties. The reason was that the President at that time cut government spending in half.

You might say what does this have to do with the business of building boxes? My answer would be everything. And that guys like Basset are commendable in the extreme, but it doesn't have be such a daunting task…

Or maybe we should stick with the status quo?

From contributor Jo

Pat,

It is absolutely not true that there was not inflation for the first 130 years. This is trivially verified by going to any inflation calculator and checking. People make arguments about whether it was worse or better than now, but nobody says 0. Try googling "inflation during the civil war". You'll see some terrible examples of out of control inflation. Maybe you were just being dramatic but such an easy to refute statement really hurts the rest of what you wrote.

From contributor de

another point- that dollar you buried in 1913 probably took a week of work to earn.

Today it takes maybe a minute or two.

more important is what could you buy for your hour of labor, then and now.

From contributor Pa

Jonah

No there was ZERO inflation during that time. As I stated the only exception was war.

In fact it could be said that the Fed Reserve Bank is mainly there to facilitate war through inflation.

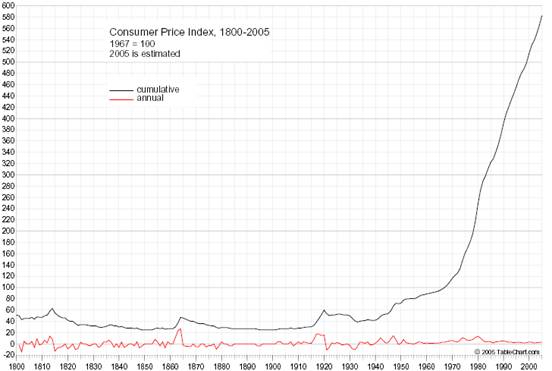

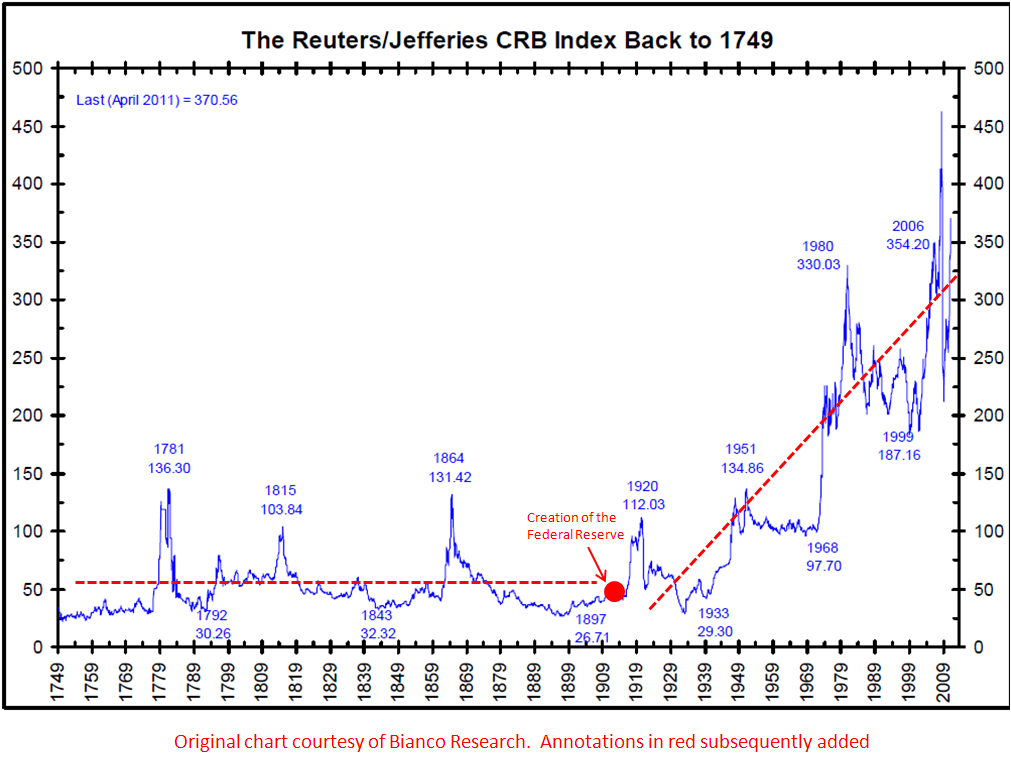

As you can see by this graph that there was ZERO inflation except at times of war.

Notice the hockey stick after 1971 when the US went off of Bretton Woods.

From contributor Pa

dean c

The point is that the inflation is not even and lags the initial increase of the money supply. This gives the advantage to those closest to the money supply (big banks and cronies) as they can invest in stock or real estate ahead of those whose wages rise later.

From contributor Jo

Pat,

Your graph does not show zero. It shows up and down. You can say it shows much less than prior to whatever date, but not zero (unless maybe you cherry pick some particular start and end dates within there).

I even gave you the benefit of perhaps you were being dramatic but you seem to be doubling down. Making absolutist statements about complex issues does not help your argument.

From contributor Pa

Maybe you need a basic math class?

From contributor Jo

Being rude likewise does not bolster any of your claims. Your claim is that for the first "130 some odd years" [...] "this country had ZERO inflation during that time". To support that claim you post a chart that shows that there was indeed inflation (and deflation) during that time. You also used a chart that does not include the first decade+ (depending on whether you go back to the Constitution or the Articles of Confederation) of data.

So to teach me the basic math, what was the inflation in the year 1803? 1812 (obvious war relation)? 1825? 1881? As I said, perhaps you are being dramatic and using hyperbole, but there *was* inflation.

You could say maybe even that there was effectively no inflation, or basically no inflation, etc. What you can't say is what you did say.

I don't even disagree with your overall point, just your absolute and absolutely incorrect statement.

From contributor Pa

In grade school math you learn that a line going down indicates a declining number. This is the case throughout the graph with the exceptions at wars, which have stated several times.

The spikes were at the war of 1812,the civil war at 1860 - 65, WW1 at 1914-18, the inflation may lag the war some but the war was still the cause. And WWll and then 1971 when Nixon took us off Bretton Woods which was caused by the Vietnam War and then hockey sticked to what you see.

If you don't understand this I cannot explain it to you.

From contributor Jo

No, you can't explain it because apparently instead of simply saying yes, ok, what I meant was there was very little inflation you become rude and condescending.

That war of 1803 (which by your argument is the only thing responsible for any inflation) was a doozy. Don't forget the wars of 1836, 1881, 1903, Or maybe you're including Indian wars? Convenient since that would leave you with a war in basically every year.

No thank you to any more discourse. I'd hate to see how you respond to more substantive arguments.

From contributor de

maybe it's nitpicking, but if you say ZERO then it needs to be a flat line, or one that dips below zero during deflations.

If you say little, or virtually none, then that's okay, because the chart does indicate that.

From contributor Pa

As stated before EXCEPT at times of war there was zero inflation. I can't find it right now but there was actually an 11% deflation from 1776 to 1913.

Inflation = increased money supply

Deflation = decreased money supply

Here is another chart showing that there was zero inflation from the 1700s until 1912.

From contributor Pa

Any way you guys are missing the point.

Once again the point is that inflation robs from most and hugely benefits the upper .1%.

From contributor Am

And you still believe "this is not about politics?"

From contributor Pa

And you still believe "this is not about politics?"

Are you amazed?

And no, it is very specific to what I'm talking about.

From contributor Ke

Pat,

If you "prefer not to talk about politics", don't.

From contributor Pa

I'm only talking about economics,

From contributor Ji

Pat, I have read several of your threads on this topic. O r at least they seem along the same vein.

My question to you is: You seem very intent on trying to convince the people on this forum of your views. However, this forum doesn't have the power to change the system. What are you doing to implement the changes of which you speak? How are you getting your ideas to the powers that be so that they can understand and make changes? If they won't listen, how are you working to replace them with people who will listen and look at your suggestions?

From contributor Am

Jim,

Pat's opining on this forum is part of a personal campaign of his to help edify the electorate. Many people in our industry get all their information from venues like this. At least this forum represents a cross section of opinion and is not a silo of like minded pundits that most people get all their education from.

I disagree with Pat all the time but that is because I am usually right and he is usually wrong. It is still comforting to hear what he has to say if only to corroborate my own wisdom. I think this is a great platform for his ideas.

From contributor Pa

Jim

I thought it was apt to post a review of a book about the wood manufacturing business. Especially the part about a guy who did not acquiesce.

It is true elections are bought and paid for by the donors. The thing to keep in mind is that change comes in unexpected ways. E.G. record low prices for oil, a new political party, a new reserve currency.

I'm not really in the hope business, i.e. odds are overwhelming that this country will not change and will wither like Japan or just collapse from a default. Japan has a demographic problem with little immigration. The US also has a demographic problem (not as bad) but allows immigration. But an inability to train people, coupled with a new reserve currency that forces a balanced budget will be quite tumultuous.

I'm not so stupid as to think I could change the opinion of anyone, especially people as stubborn as woodworkers.

Anyway my only purpose was to talk about the article and what is rattling around in my skull. Is that not the purpose of the forum?

From contributor Da

I only agree with Pat when we are so diametrically opposed that we meet on the backside of the continuum. But, I enjoy reading his passionate appeals, and I know he does not come by this lightly or by listening to some hot-head on the radio.

Stewart Brand once said you can't know where the center is unless you know where the edges are.

Most importantly, he gets me thinking, and that is never a bad thing. Many of the best things were once new ideas, foreign and isolated. Almost nothing now is working so damn well that we should be holding on tightly to it as if it were our only means to salvation.

From contributor Pa

Most of those radical ideas, come from some people, that were so radical that they started a revolution against their mother country.

From contributor Ke

Pat,

Your list of prescriptions in post # 13, starting with ending direct election of US senators and including an absolutist reading of the 10th amendment and abolition of public education is far from "only talking about economics". That's ok, and if I weren't interested in politics myself and only haunted this forum for tips on how to run a woodworking business I would pass over your posts without even looking- but don't kid yourself that you are only making observations about economics. No offense meant; I like to read viewpoints from various angles to clarify my own thinking, such as it is.

From contributor Pa

That was only in response to James, who wanted to sound the depths of my insanity.

From contributor Ke

Full fathom five.

From contributor pa

Considering what is "normal", thankyou.

From contributor Se

Everyone in the 99% despise the 1%, yet in every discussion, never does anyone ask how to become that 1%.

If you are living hand to mouth, is is much more likely because you have made poor decisions rather than any abuse by the government or foreign competition.

The biggest threat to our economy and our livelihood is the ever increasing percentage of the population the derives it's income from the taxpayers, be it welfare, or government employment. Too few workers and too many freeloaders. The freeloaders have become the majority and will continue to vote in those who feather their nest.

From contributor Pa

Couple of points.

There is welfare and both ends of the spectrum at the top we have TBTF at the bottom we have public transfers.

The reason for the growing income disparity is simply inflation. When you pump 4 trillion into the economy it inflates certain parts of the economy and not others it inflates Real Estate, Stocks, Collectibles. Oil Wells, etc. So if you own some of these things your wealth goes up.

At the other end of the spectrum you know the story, section 8 housing, WIC, food stamps, permanent disability (now 10 million), etc

The biggest entitlements are going to go to the boomers. IOW the biggest threat to the economy is medical care to the boomers. They will collect about 7 times more than they put into the system. This is NOT political it is a math problem and come 2030 the greatest depression this country or the world has ever seen will come.

25% of the budget at that time will go to debt services, the remainder will not cover the medicare costs. This is a demographic problem but the rest of the world will be going thorough it as well.

The last of the baby boomers will be on medicare at that time.

My advise is to be completely debt free by then.

This is the prediction from the ITR and the Beaulieu brothers. They are Austrian economists and worth listening to.

From contributor Tr

Posit the question:

Would an original post about socioeconomic history garner 40 responses that were book reviews?

From contributor Pa

Juxtaposition

Since you posit, you are de facto using a posteriori methodology, which might be inconclusive. I recommend that you instead use a priori methodology. That way the answer is by virtue of the fact that it has 40 answers and it is about a book review the answer is yes.

I contend the interest comes from the idea that those who remain ignorant of history are destined to repeat it. At least with half the posts, I can say this with 100% certainty.

From contributor Am

Pat,

Has it ever occurred to you that history repeats itself not because of a lack of critical thinking or a ignorance of things that happened in the past? Could it not also be that these patterns are so similar because the underlying motivations of people have never changed? The technology might be different from season to season but the dopamine is stiil the same.

From contributor Pa

Amazed

No, splain some more, maybe you can learn me some stuff?

There is the Kondratiev wave, which I'm not sure how to use.

There is also the Elliot wave that I'm even less sure how to use.

At the end of the millennium people are trying to survive. Survival is not a yes or no proposition it is to what degree. People survive through their children, their group, their animals, etc. To that end I suppose people's conduct does have a certain amount of repetition?

From contributor Tr

Pat Gilbert:

"Posteriori methodology"? That's probably a little deep for a high school dropout like myself. I bow to your clearly superior formal education.

At least for once, the post you hijacked was your own.

From contributor pa

Hijack, how do you figure?

From contributor Pa

What upper level education?

Besides edjumucation is free now. IOW look it up...

a posteriori is used with the scientific method. This does apply to economics. It is used with hard sciences to prove this or that.

a priori is what mathematics is based upon, economics and soft sciences use a priori.

This is the fundamental mistake with Keynesian economics in that they try to use a posteriori methods on a soft science.

From contributor La

Pat, thanks for the book review. Economics and politics are so interconnected that they can't be thought of as two separate things. Money will buy almost anything, especially politicians. Gold standard, irrelevant, could just as well be beads or seashells. Putting an arbitrary value in terms of some currency on it simply distorts its value. Locking piles of it in a vault does what for the economy? Inflation hurts those holding cash or its equivalents the most. Those @ the bottom of the pile will get their "cost of living" increases. Those with most of their value in equities or tangible property will retain their value in real terms. Those with debt will benefit by paying back in cheap money. Those who put their savings into CD's of the like will get screwed by being paid back with cheap money. Government regulation has its place but is often distorted in favor of votes. It should function as a referee or protector. End of my politics.

From contributor pa

Larry

The trouble starts when a currency's value is enforced by fiat, and deviates from the value of that money as determined by the market place.

Gold is the most trusted currency as determined by the market place.

From contributor La

"The trouble starts when a currency's value is enforced by fiat, and deviates from the value of that money as determined by the market place." THAT is exactly what is done by using Gold as a currency!

"Gold is the most trusted currency as determined by the market place." ANYTHING can be a currency that is trusted by the market place. If it is rare or difficult to come by it will work fine. In a few cases even toilet paper has met that standard.

-

From contributor pa

Yup in some environments it is cigarettes.

I'm not talking about what could be, I'm talking about what is.

As much as the central banks would like to convince you otherwise that currency IS gold. Especially when inflation gets going.