Message Thread:

You're welcome

9/18/19

Just the facts

View higher quality, full size image (910 X 661)

9/18/19 #2: You're welcome ...

Pat Gilbert:

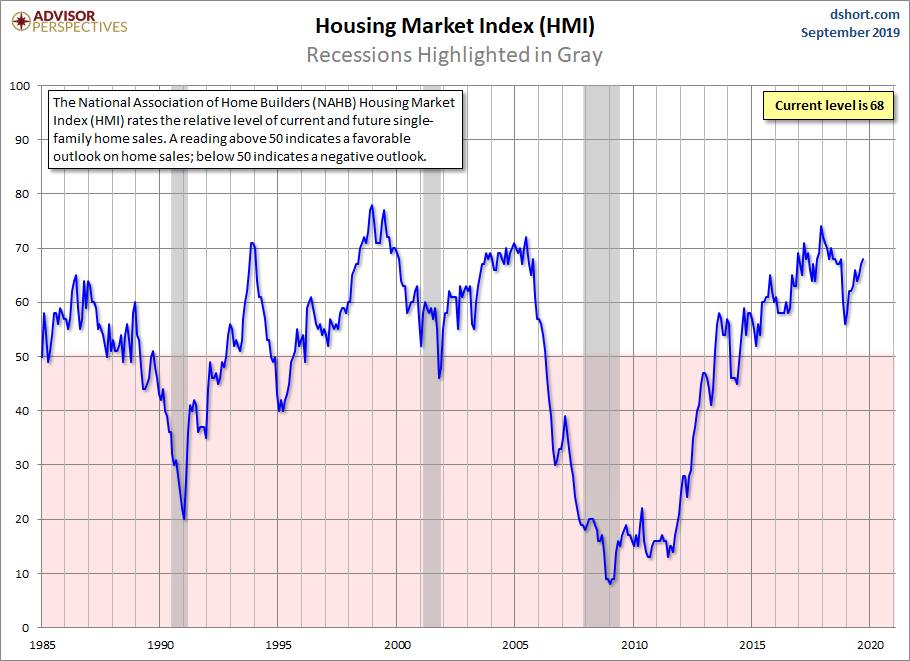

You say "you're welcome" as though you are solely responsible for the HMI. :^)

It appears that we are either on the brink of an impending recession or an unprecedented boom, probably the former.

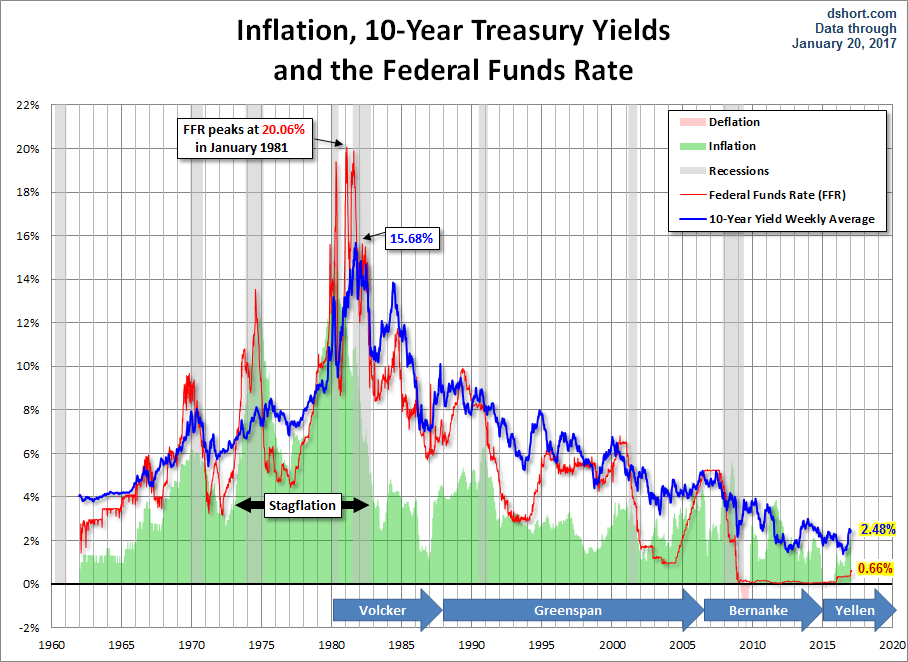

I don't know if the HMI would indicate this, but going back to the energy crisis of 1974, when $0.33 a gallon gasoline breathed its last breath,and the interest peaks of 1980, when I bought my first house with a 13.875% interest mortgage, the true roller-coaster of a housing index might be more apparent.

Perhaps because single family real estate was still a thing back then, people kept buying no matter what, as I did.

Interest rates that were once the sole provenance of corporations like Household Finance became commonplace for mortgage institutions.

The only reason I was "lucky" enough to get 13.875% was because I locked in the rate, otherwise it would have been 14.25% at settlement time.

People who bitch about a 4% mortgage would do well to take a look at my first amortization sheet and reflect on how good they have it.

TonyF

9/18/19 #3: You're welcome ...

And then all you have to do is talk to a wide breadth of local residential builders to find out that the index is skewed colossally by a few choice markets. The bulk of those that make up the remainder are not seeing such a rosy picture.

These graphs are lesser relevant than ever in that certain markets and pricing demographics can sway a national average more easily than ever. There are entire states that have abysmal housing market numbers.

So the ultimate answer is to get out your cardboard boxes and packing tape and move. Move to the markets that skew the stats. Then of course the impending doom will be quicker due to saturation.

9/18/19 #4: You're welcome ...

I did not imply that I was responsible for anything, you may have inferred it?

I was implying that the statistics do not indicate a recession

Oil in 1974 was a lot different than today, the US is the 2nd largest exporter of oil today and the largest producer of oil.

Single family homes are relevant to families.

Interest rates are determined by the bond market a 100 trillion dollar activity

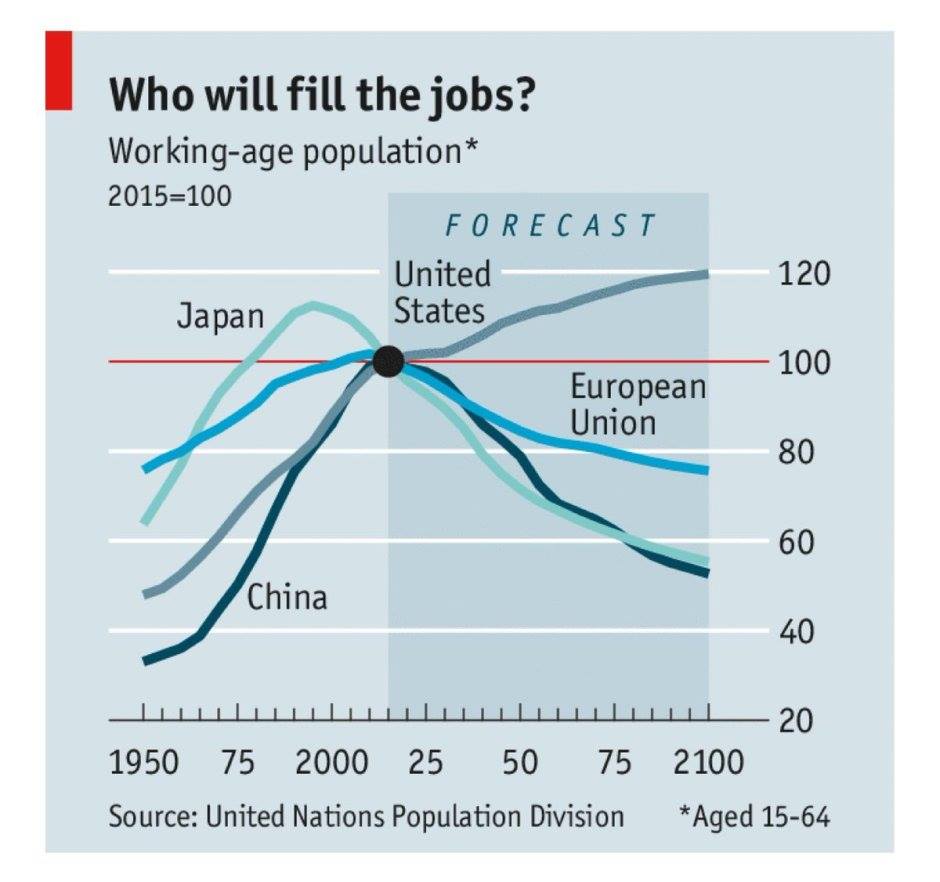

The reason interest rates have been going down for a long time is that the demand for money have been going down for a long time(see the chart). When people get old they quit spending money

Anyway there is Not going to be a recession anytime soon, you're welcome.

View higher quality, full size image (1168 X 450)

View higher quality, full size image (908 X 662)

View higher quality, full size image (940 X 882)

9/18/19 #5: You're welcome ...

Mark

It is true that aggregate date gets skewed.

States that have a shrinking working age population on going to fare worse

As to the impending doom I don't see any evidence of that.

9/18/19 #6: You're welcome ...

"When people get old they quit spending money." (As foolishly)

Lots of corn fields in my area are being ruined by housing developments. Bigger is better! Houses have grown bigger and use less durable materials. In the 60's most of the cheapy 2 bedroom houses had stone or brick exteriors, There are no 2 bedroom houses being built and 2,000+ Sq.Ft. is an entry level, covered in cheap plastic siding. (The up grade is 10 bricks by the 3 stall garage.) Does any of this skew the statistics?

California politicians seem to be good about complaining about the high prices. I see where a town near Sacramento had fees of $35,000 to build a new house.

9/18/19 #7: You're welcome ...

I know lies, damn lies, statistics...

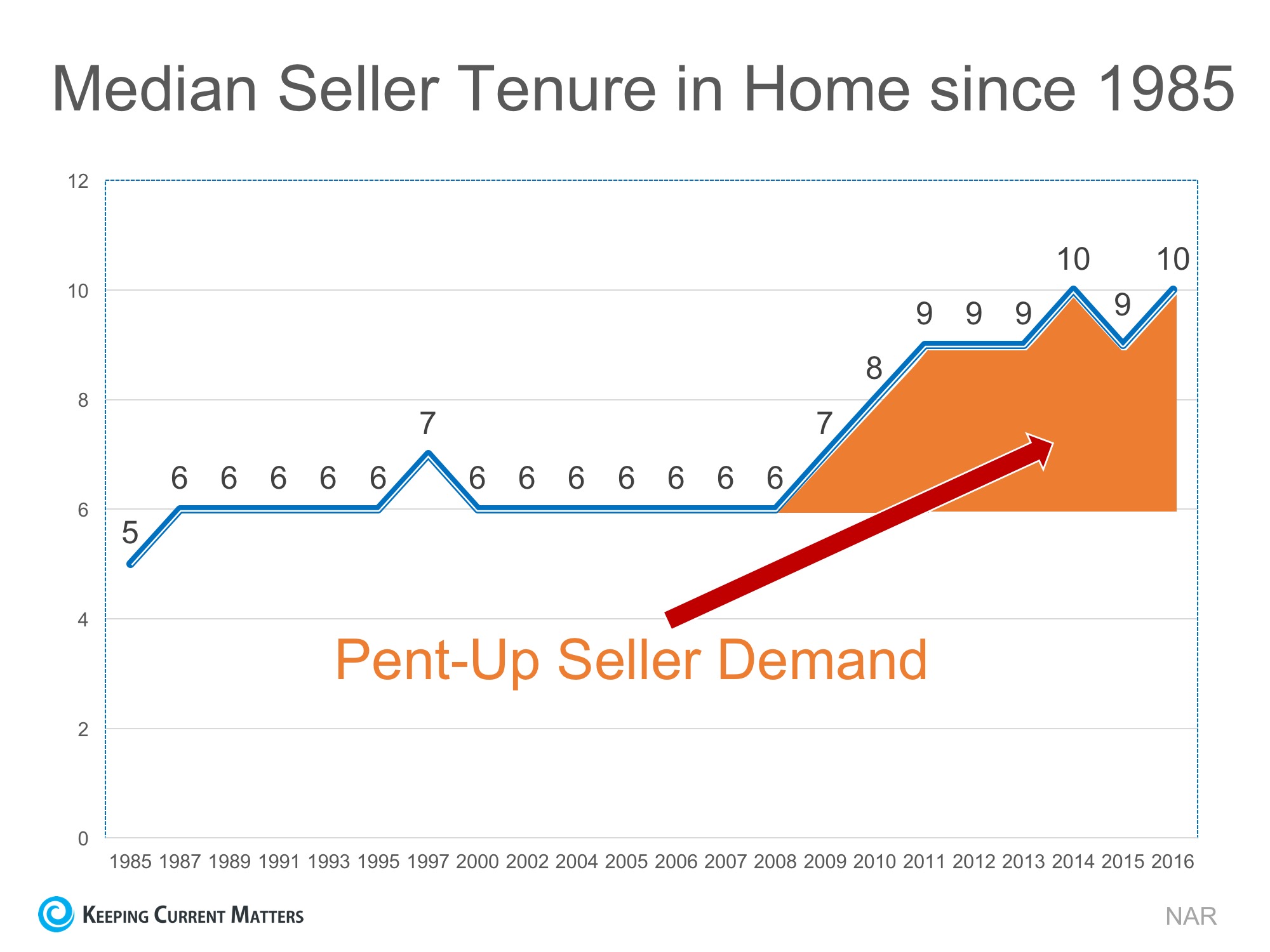

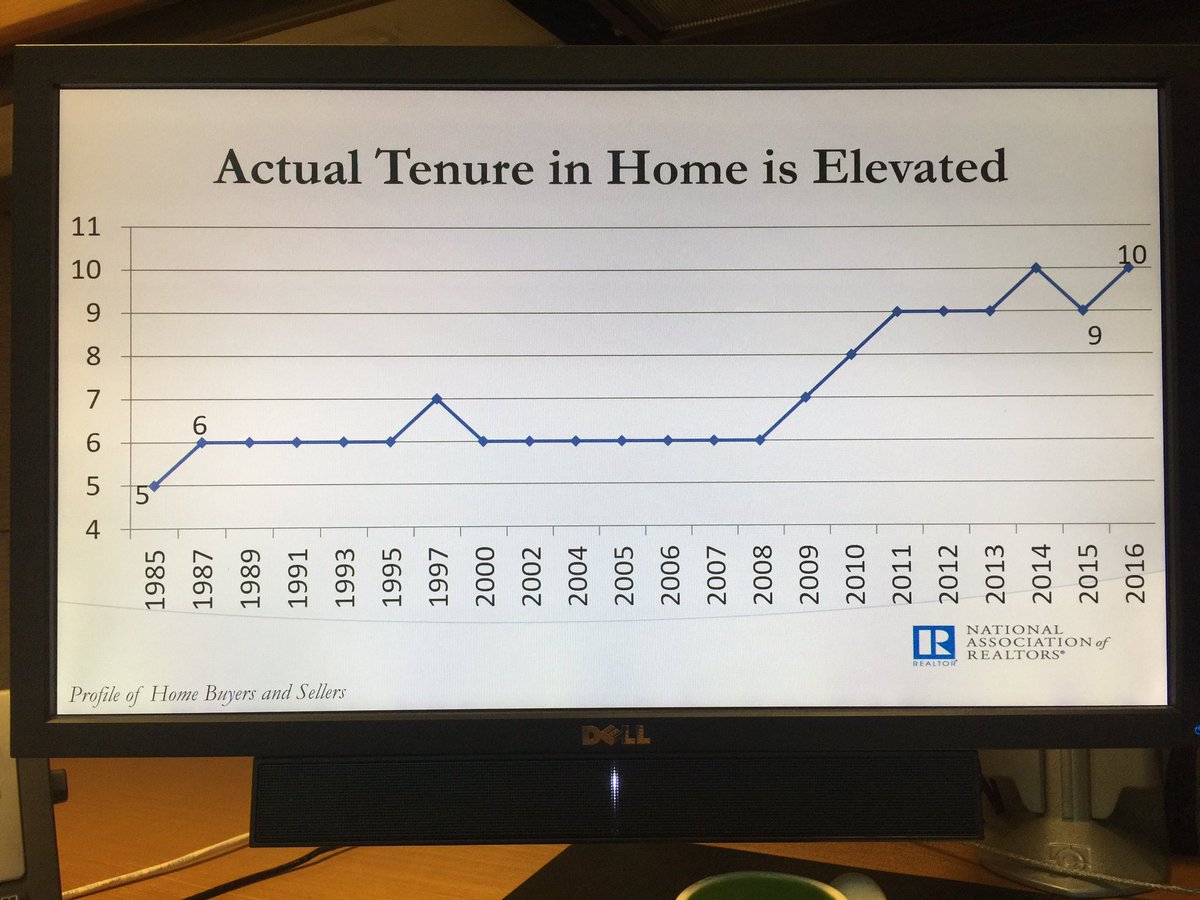

The apt statistic is home tenure, and yes the statistics accommodate that anecdotal observation, indicating that people stay in their homes longer because they are big enough.

View higher quality, full size image (2000 X 1500)

View higher quality, full size image (1200 X 900)

9/18/19 #8: You're welcome ...

California costing so much is mostly over regulation. Much of it is NIMBY related.

35,000 sounds way high for even California

Yeah our current governor has instituted state wide rent control to fix the problem. And you thought Brown was bad...

The reality is that Calif has the biggest economy in the US, and the STEM workers that come here spend money. It helps that such a person with average skills makes big money because the FAANG companies have capitalized on the opportunities of the internet

I was working a job about a couple years ago where the rent was IIRC 3K to 6k a month, with a Whole Foods in the apartment building.

I asked the Super who could afford these kind of rents. He said go out front and look around. There right across the street was Dream Works, Marvel, ABC, et. al. I assume workers on computer animated entertainment domiciled there.

9/18/19 #9: You're welcome ...

Pat Gilbert:

Perhaps you noticed the old-school, ASCII smiley emoticon at the end of my first sentence. Some people might interpret that as "just kidding".

I wonder how much of extended home tenure is attributable to the fact that, given underwater mortgages, student loan debt, home equity debt, and using credit card debt to finance the purchases of non-durable consumer goods and services to prolong the illusion of a middle class lifestyle, that people simply can not afford to move?

As for there not being a recession soon, the Fed does not cut interest rates because the economy is booming, and you can only cut the income tax rates so much, unless you want to continue to increase the national debt, because there are governmental expenditures that are necessary, whether people want to pay for them or not.

The national debt was something that one of the political parties was very concerned about until last year. And then, something happened. I suppose with the money going into their pockets in the short term, they can now look the other way.

Most of the reported good economic news does not seem to be based on a very solid financial foundation.

This is just how I see it, I don't have any charts to back me up.

TonyF

9/19/19 #10: You're welcome ...

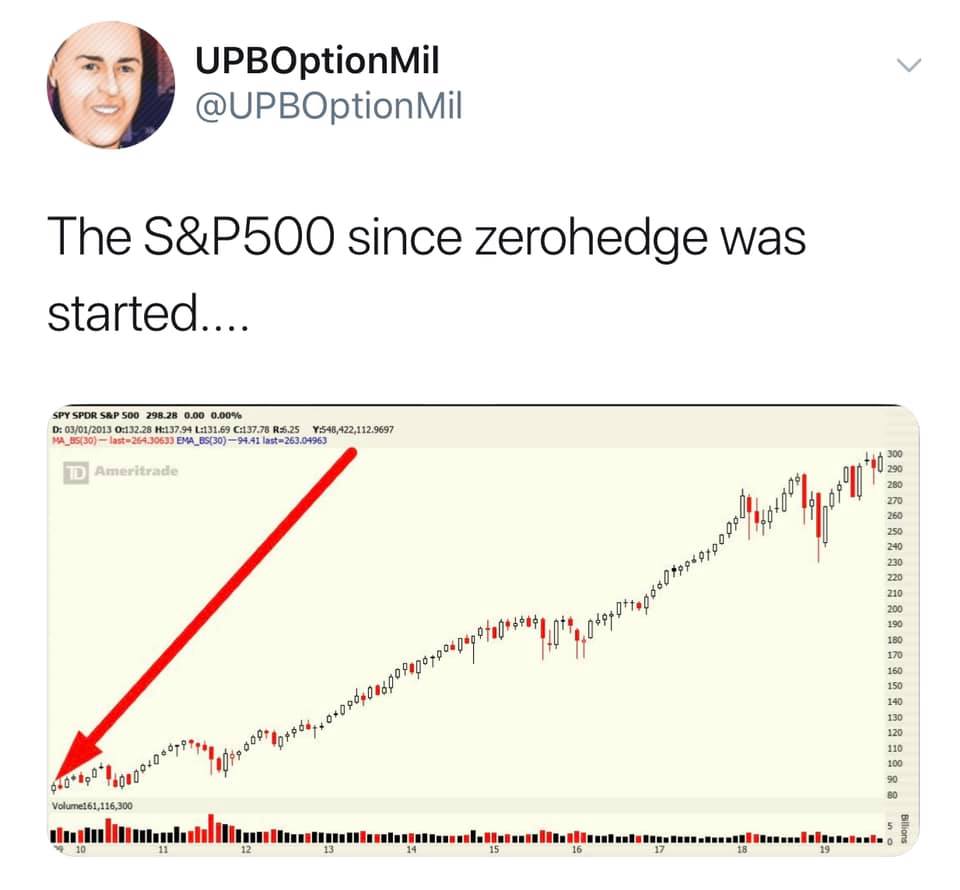

Charts are just statistics in a visual format. And we all know there are lies, greater lies and then statistics.

View higher quality, full size image (500 X 320)

9/19/19 #11: You're welcome ...

Website: mcgrewwoodwork.com

Website: mcgrewwoodwork.com

All I can say is I have no intention of not being prepared for a recession (or worse) when someone is not afraid of Bankruptcy

9/19/19 #12: You're welcome ...

Tony pretty much took the words out of my mouth.

Not that talking to a pretty fair amount of people in varied markets covering perhaps 1/4 to 1/3 of the country is equivalent to a national economics report but the conversations I have had with nearly everyone from high to low, left to right, is they are staying put and not upgrading moreso because of clear and concise uncertainty in combination with pretty much barely making it where they are at and not really looking to incur any additional expense. In the conversations I have had being content with their situation is not the motivator for staying put. Its more of a hunker down philosophy.

On the housing side I personally feel there are a lot of contributing factors there and one may be that while they dont quantify it as such, there may be a bit of a base level simmer that having traded a vast amount of quality for square footage was not so wise based on the 50's, 60's, 70's, concept that real estate is ALWAYS a sound investment. Seeing that their base level construction and finishes that "we will upgrade later when we have more money" doesnt play out so well. As Larry said, a lot of fly-em-out fast monsters with drywall returns, no casing, entire interior airless blasted with Promar200 Egret eggshell to hide the drywall, maybe not so great in the long haul. More and more I seem to hear especially young people clearly seeing that property ownership (single family dwelling) is not the bundle of joy their parents and grandparents made it out to be and is rarely ever a 10X return on your investment anymore.

I recently had the opportunity to have a conversation with head of state commerce. His statement was that in all of the agencies travels through the state speaking with a broad range of industries, that the general consensus is no one in average markets is feeling the love thats being floated on state and federal levels.

Its not really a shock to me given the last 15 or so years.

9/19/19 #13: You're welcome ...

Tony, yes I missed the smiley emoticon.

The thing about debt is that the people most able to own debt have it.

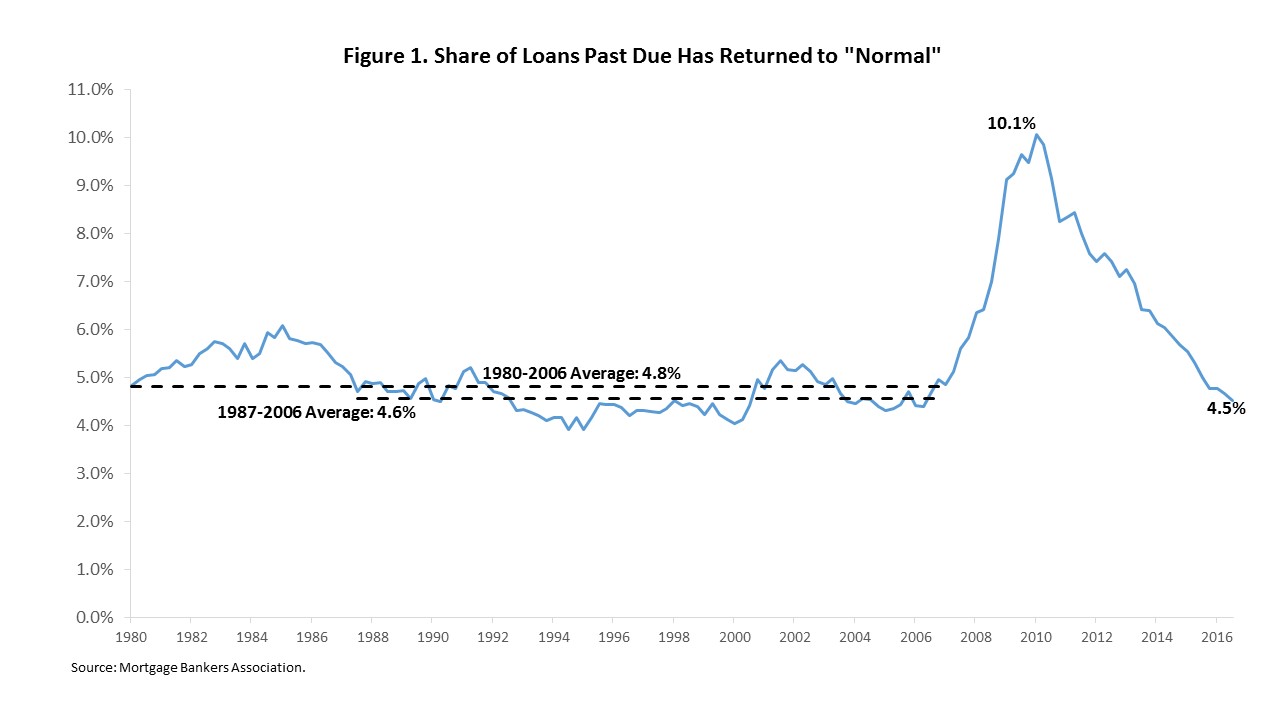

The debt these days is not like the pre crash debt.

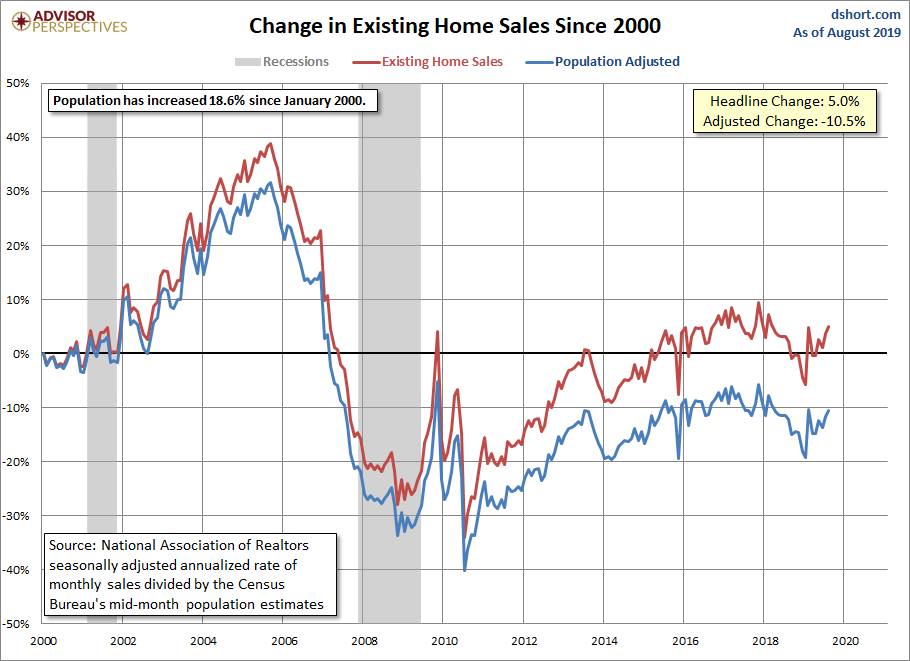

The price of housing as come back to pre-crash levels on a nominal level. So the underwater mortgages idea isn't possible. And HELOC abuse is a thing of the past, see the chart on mortgages

The fed cut interest rates a 1/4 point yesterday (yet the 10 treasury bond went up, go figure) because next year is an election year and Powell want's to keep his job. Like I said before the bond market is a 100 trillion dollar market if the fed changes interest rates too much bad things happen like they did to Greenspan

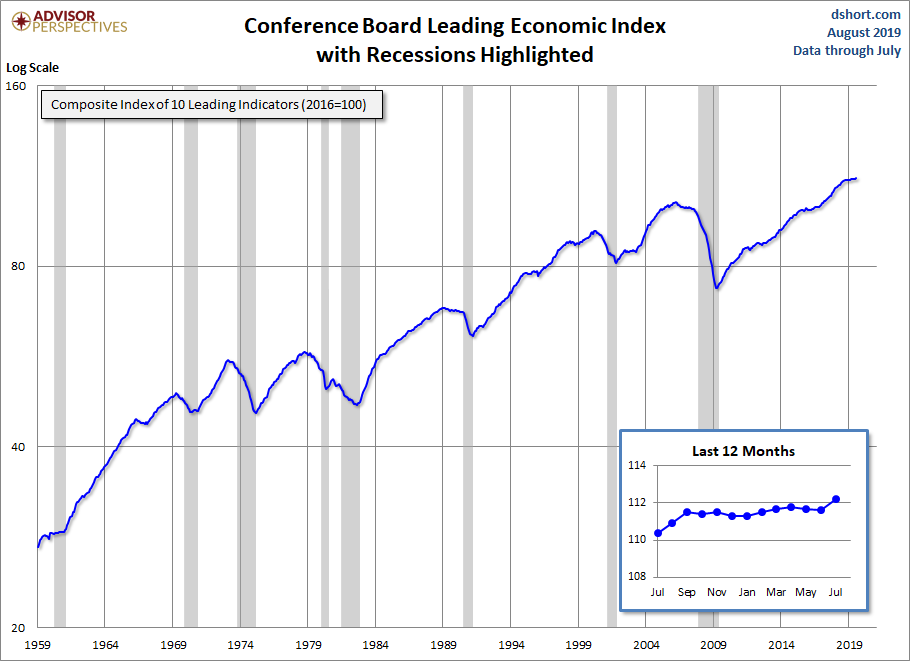

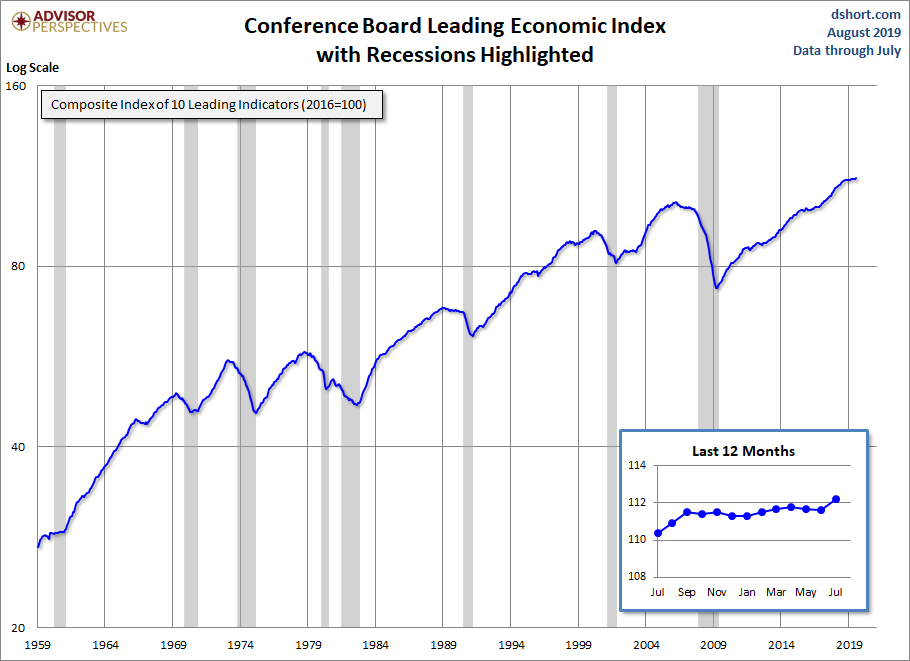

The good news is based on solid data that is known and accepted, if nothing else look at the LEI chart.

The debt is astronomical and I agree it should not be there, problem is All politicians spend their way to reelection.

Anybody loaning money looks at your balance sheet and your assets. The US has 100s of trillions of assets. The dollar is a very strong currency. Rome lasted for 1500 years. Yup eventually the US will collapse too but that is not for a very long time.

View higher quality, full size image (1280 X 720)

9/19/19 #14: You're welcome ...

Charts

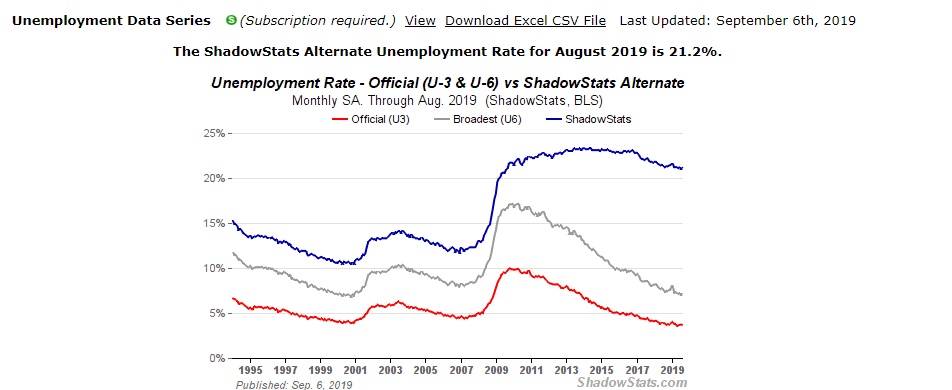

Shadow Stats posts a 20+% unemployment in the E6 unemployment rates. With an under 4% unemployment rate for regular unemployment. Really???

I'm sorry to be bearer of good news

View higher quality, full size image (952 X 390)

9/19/19 #15: You're welcome ...

Mark

Yes the aggregate data can skew regional data.

But the housing tenure certainly shows the trend. Quality issues or not

The main point is that there is not enough evidence to say there is going to be a recession.

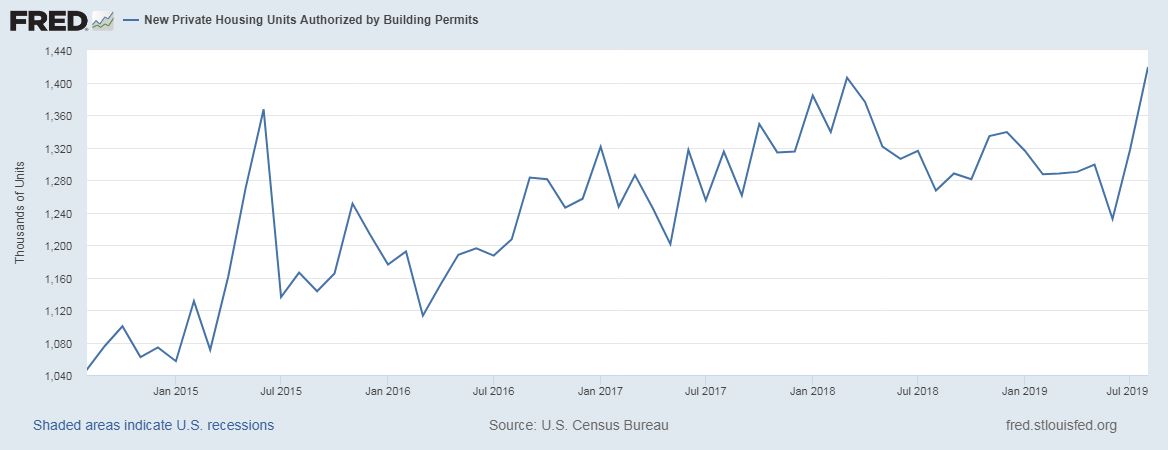

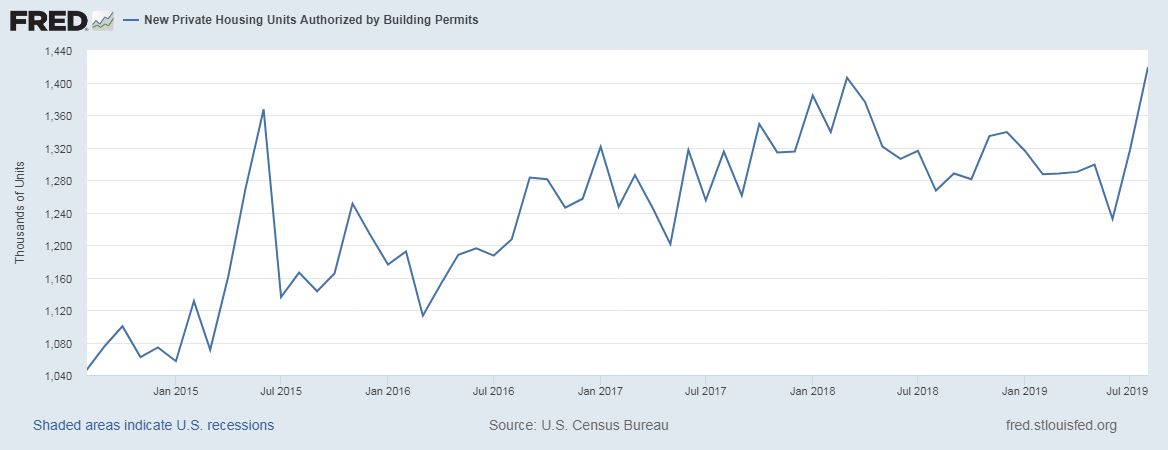

Another factor to consider is that there are 140,000,000 homes in the US. Existing homes are always going to be cheaper than new homes because they were built with yesterday's costs. Even though the data looks good economically new home construction is likely to remain flat.

As the boomers die off there will be a lot of houses on the market. Even in Japan, the oldest country in the world, housing figures to come down in cost.

9/19/19 #16: You're welcome ...

In every instance it has been espoused that there is not enough data to forecast a recession or the lack thereof. Thats the line of the profiteers of the economy so they can reap the highest margins out of the last few breaths before it all hits the fan. It happens every time. Millionaires are made off recessions, and billionaires are made into multiple billionaires, because they are the influencers. Its merely a game.

Its a line that is fed out to the minions while the masters peel the millions. Thankfully for them they have an army of soliers who will never be rewarded in a share of their spoils that faithfully spread the word.

A bonus of living in a non-boom area is even in the worst fall your only going to drop a run or two.

--> ;-) <-- incase you miss it.

9/19/19 #17: You're welcome ...

😊

There is enough evidence for a good economy though

9/19/19 #18: You're welcome ...

Again,

May be true in, polls, and graphs, but when you have the head of commerce and numerous other markets commenting clearly to the contrary as they attend events trying to figure out why they dont have an office impregnated with the overwhelming smell of roses... you begin to realize the fixers are at play.

It doesnt take a genius to figure out that we weepuls are merely the makers of the millions.

9/19/19 #19: You're welcome ...

My location has been one of the best performing over the last decade. I donít care what the charts say my contractors- who are on the leading edge of the curve of my shop by 3-4 months are evenly split. 1/4 donít have work (after pulling 6 days a week 12 hour days for years while only being able to get a fraction of the work done offered to them) and are sitting idle due to not having work. 1/4 are in hunker down mode- building but vary wary and cutting back where they can (checks are very slow). 1/4 are busy, but terrified of a stagnant to negative market as they have boom costs input but sellers arenít buying hand over fiat at boom prices. And checks are slow. 1/4 march on blissfully unaware. The middle two groups I would consider my most economically and financially savvy. The other two are always hurting, even in the boom.

I donít care what the graphs say, because quite frankly the two sources you are getting info from either make up information out of thin air to benefit themselves OR their livelihood depends on good info and as we know that effects how they perceive it.

Chart me to London and back, I donít care, I ainít buying it.

9/19/19 #20: You're welcome ...

Mark, If you want to make part of the millions, & you are sure a crash is just around the corner. Turn you assets in to cash. When all those houses come on the market at depressed prices buy up the most expensive ones. Hold them for a couple of years and then sell into an up market. I had a friend do that on borrowed $. Retired when he was 40. You can also do similar with the stock market. Takes some luck & brass ones. Opportunity only knocks every 10 or 15 years. Jump in if you are sure a crash is emanate.

9/19/19 #21: You're welcome ...

Ok, you'all have convinced me, things are going to be terrible.

9/19/19 #22: You're welcome ...

Timing is everything. I learned long ago that I can't do it, so just keep some dry powder.

9/19/19 #23: You're welcome ...

Larry

I used to think that too

The reason Leading Economic Indicators are called that is because they are that

9/19/19 #24: You're welcome ...

This one didn't post earlier for some reason

View higher quality, full size image (910 X 661)

9/19/19 #25: You're welcome ...

No one said miserable. Your just not going to be one of the multibillionaires.

Honestly Pat. Carrying this torch all this time are you sitting in a 15 mil mansion with limited interaction on a 150mil a year cab shop and sipping sweet tropical drinks on a yacht?

If life were 13.85% of the rosey I'd at least have a row boat.

9/19/19 #26: You're welcome ...

Nope but most of yous think the world is going to end, it taint

2008 left a mark on all of us, and the economic news agencies don't know which way is up.

I'm not saying that it's all going to be rainbows. There just isn't going to be another recession now and when the recession does come it is not going to be like 2008.

Sorry to be the bearer of good news.

But if you insist on putting in the bomb shelter, knock yourself out.

9/19/19 #27: You're welcome ...

Pat, yet you try to convince us with a poll of people in construction who are faceless and who we do not know. Yet every single person you speak to here who is on a job site, speaking with clients and has their ears to the ground tells you differently. Me thinks you want to believe what you want to believe and would rather believe mass polls- geez, those havenít been proven to be absolute folly over the last dozen or two years- than your fellow business men.

9/19/19 #28: You're welcome ...

The believing what you want to believe thing is a two way street.

I got interested in this stuff after the last recession. My interest was to find benchmarks that are prescient as to what to expect.

Recessions are quite easy to predict.

9/19/19 #29: You're welcome ...

Pat:

First you make the statement that according to you recessions are easy to predict. If you truly believed your own words youíd be smarter than guys making many millions a year who manage hundreds of billions and even trillions and even our economy. Youíd also be leveraged to the hilt because youíd know right? You couldnít lose!

Iím not sure what worries me more, your confidence in cooked numbers or your confidence in yourself being the smartest guy on the planet. Either way it makes me doubt you even more with each protest.

You arenít the only guy doing your homework and I bet a lot of them have also backed their beliefs with their money (and the proper hedges because they are humble enough to know that the market can stay irrational longer than you can stay solvent). Have you backed your beliefs with your money? I mean itís SO easy to know right?

9/20/19 #30: You're welcome ...

Yes, I'm sure you are right.

9/20/19 #31: You're welcome ...

I dont think for a moment there is impending doom. Though what doom "is" is a relative term. Its just all the same slog day in and day out. Groundhog day.

The system is nothing like what is purported or the days of old. The powers that be, the ones who control the market, will not allow another depression because the 1% is not going to allow their plunder to be jeopardized. The talk of Rome and blah blah blah is gobbledygook.

The controller of the economy is no longer "the market", or the consumer voting with their wallet. Its the 1%, the speculators, the power players. They will only allow a recession if there is a clear profit potential (and will). These are the same folk that give us the shaft with elevated gas prices every holiday or when a Monarch butterfly farts on its way to Mexico triggering a tropical depression that may, or may not, develop, and may or may not head for the gulf coast, but we pay the price hike anyway. They choose what we will be offered to purchase not based on what people want, but what they can most profit from. Its a perfect system for them. If you really want something but their margins are not there, they disallow it. Then, unless you willing to do inordinate amounts of tracking down, shopping, searching, re-searching, the consumer just buys from the offering presented. The days of voting with ones wallet are over and have been for many years now. Ask anyone how much time they spend searching and tracking down something they want to buy. The hours spent searching now are nuts, because the controllers are only offering junk that gives them 105 billion dollar net worth for one individual profit margins.

As clearly outlined in this conversation, the graphs and polls are meaningless for the bulk of the country and only apply to the influencing markets which I guess makes sense as thats where the cash and people are, kinda.

Weve been hearing roses and sunshine for years and no one in the trenches that I speak with are seeing it.

All good information though.

9/20/19 #32: You're welcome ...

You're not hearing me.

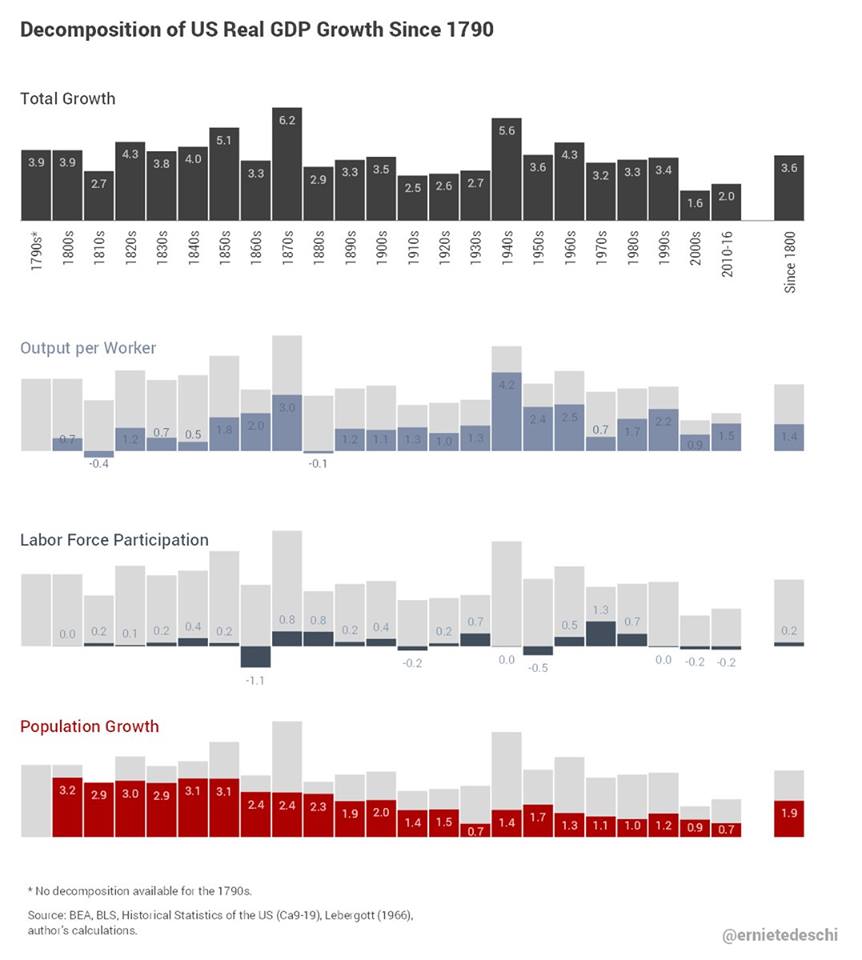

The key is in this chart on the bottom row. There were 2 significant events in the US economy in the last 100 years. They both show up as the lowest growth in the working age population in the last 100 years.

I'm not selling anything, I have no torch. It is a hobby horse of mine, take it or leave it, I don't care.

View higher quality, full size image (862 X 960)

9/20/19 #33: You're welcome ...

I, for one, have noticed and enjoyed the lack of meaningless charts and graphs on this site lately. I can honestly say I have not missed them one bit. I know, you can say if I don't like it don't read it.(which I mostly didn't) Just say'in.

9/20/19 #34: You're welcome ...

You're welcome

9/20/19 #35: You're welcome ...

I'm curious how any of this affects what any of you do on a day to day basis?

My backlog is 4 months. It's been 4 months since 2010. I bid on average $650,000 a month and that hasn't changed in years. Last month was no exception, this month is no exception. I will continue to bang out jobs until the jobs stop coming. The decisions I made after the last recession will ensure that the next recession does not harm me. I hope any of you that made it through the last recession made similar decisions. If you did, then what does any of this matter? If the work stops coming then it stops coming, and if it doesn't it doesn't.

9/20/19 #36: You're welcome ...

Website: http://www.sogncabinets.com

Website: http://www.sogncabinets.com

Last year, we were balls to the wall.

I added a cnc and another guy. (Three including me, to four including me)

This year has been a struggle to keep things rolling. Production is up, sales are down.

I don't know what next year has in store, and neither does anyone else. Hopefully were back to busy and growing.

9/20/19 #37: You're welcome ...

We are in essentially the Seattle and it's retirement community market.

I'm thankful to have the type of relationship with my builders that I know them and their families by name and call them friends. We share information openly.

My largest builder is cutting back from mid 20 homes this year to 12 next year and scaling back slightly on size/pricepoint/features.

My second largest builder is going from 7 homes- usually near the top of the sales market in each suburb they sell- to maybe, perhaps one. Maybe. Possibly zero.

My third largest is business as normal until early summer and unknown after that.

My fourth largest has no homes booked or planned and currently is pulling out what is left of his hair.

My fifth is busy with remodels.

My sixth was idle and just recently started a last minute home but nothing for next year yet.

Same thing down the line till I can't keep track of them or rank them further.

That said the rest of the year is the best four months ever but they are develpments, homes, foundations that have been in the works for a year plus. Momentum.

I'm actually looking forward to a downturn. Need some rest. Passed on more work than I took these last ten years and we took all we could handle and then some. No debt, outsource as much as I can so all even a deep recession does to us is first gives us rest and then we transfer work back in house (which I look forward to...I actually like woodworking!).

So while I care very much what next year holds I'm not losing my mind over it simply because we prepared. Having worked through the dot.com & 9/11 recession and survived 2008 as an owner we are prepared. Which I think is what this post is about whether I agree with Mr. Gilbert or not I surely don't mind his graphs. Planning, preparing, organizing, getting your ducks in a row, etc which is a lot of what of running a business is about I believe.

9/20/19 #38: You're welcome ...

FM

The reality is that there are 140,000,000 existing homes in the US, new construction is likely not going to boom because existing homes are going to be cheaper as they were built with yesterdays costs.

Next year does not figure to be a boom year either way, just not a recession.

9/20/19 #39: You're welcome ...

Pat, you can call it whatever you want. All I know that my builders are expecting to build 50%+ less homes next year. Mind putting a definition or name on that if you aren't happy with the word recession?

9/20/19 #40: You're welcome ...

FM

Charts that don't look like this would be a start

The gray areas show recessions

Unemployment stays at around 4%

Retail sales are up

Leading economic indicators are up

View higher quality, full size image (910 X 661)

View higher quality, full size image (1168 X 450)

View higher quality, full size image (910 X 661)

9/20/19 #41: You're welcome ...

All of the personal examples of local GC, customer, are relying on their marketing abilities.

All we can do is keep selling. If you start losing bids more lower you prices, if you are getting to many bids raise your prices.

In commercial our area (Silicon Valley, SF Bay Area) work is still strong. The big tech companies are still expanding.

If your customers are slowing down its time to expand your customer base.

If customers you haven't talked to in years want you to bid ask why.

Every business needs constant sales, keep selling every day. Figure out how to get in that other door, that other lead.

There is work out there. The people with money aren't over leveraged right now, they will keep spending. Some may be waiting for slowdown for prices to stabilize.

Subscribe to the local business journal and see who is building, which contractors are expanding ,which developers are starting projects.

https://www.bizjournals.com/

9/20/19 #42: You're welcome ...

We had too many eggs in one basket and decided to see if we could expand our customer base. We've been contacting GCs and remodelers. We've landed some new clients and been told by many that they are so busy they don't have time to consider a new supplier. Considering that the hardest part of getting a new client is being able to make your presentation to the decision maker, it's hard to do when they are swamped........

9/20/19 #43: You're welcome ...

Larry,

You just have to keep trying, you want to be to busy to take part in these discussions :=)

Alan

9/20/19 #44: You're welcome ...

Larry

The decision makers are king, mail to them every month call them every month sooner or later they will talk to you. Not if just when.

9/23/19 #45: You're welcome ...

Zero Hedge and Shadow Stats are similiar in their views

View higher quality, full size image (960 X 890)

9/25/19 #46: You're welcome ...

Not to beat a dead horse but...

Housing sales

9/25/19 #47: You're welcome ...

We lost actual cash money in 2009, that is the only year that affected our sales, we were out selling, developing new customers and have had a good run. What I didn't do was worry about the economy, I went and found work. We didn't cut wages, we didn't cut benefits.

You can speculate about the future or you can go develop new sales, find new markets, and protect yourself from the downturns. Somebody is making sales all business doesn't stop, it might as well be you.

None of us are big enough to move any of the meters / charts / graphs. There are lots of micro economies, maybe you need to sell 100 miles away.

A-

9/25/19 #48: You're welcome ...

Nobody would disagree that sales are the most important activity a business should engage in.

But "You can speculate about the future or you can go develop new sales" implies that they are mutually exclusive activities.

They aren't, specious sources of economic/future economic activity predisposes one to not working on sales.

E.G. the incessant drone of the debt is going to end the country is fallacious.

If I knew 10 years ago what I know now I would be considerably better off financially, and would not have bought into the shadow stats type rhetoric.

9/26/19 #49: You're welcome ...

Pat,

""Nobody would disagree that sales are the most important activity a business should engage in. But "You can speculate about the future or you can go develop new sales" implies that they are mutually exclusive activities. "

Most of us don't have the ability to get accurate local economic forecasting that affects local sales. My point is the media that does news is like cheerleader / doom forecaster based on national trends.

People can spend 2-4-8 hours trying to learn local economics or spend the same hours increasing sales. Discussing how bad it is for a single shop doesn't help the shop sell. I guess my point is spend more time selling, less time talking about the economy.

"If I knew 10 years ago what I know now I would be considerably better off financially, and would not have bought into the shadow stats type rhetoric. "

You would be better off because you made more profitable sales business decisions or you would have been better off because you would have made better investment decisions with your personal non business finances?

We pulled our money out the market about 4 months before it crashed, our advisor said the fundamentals didn't make sense and we should be in cash. About 4-5 months after the election we cautiously got back in the market. We have been out of the market for every recession since 92.

Our advisor makes money when the plan makes money. I spend very little time trying to decide how to invest, he manages my personal money and the company 401k.

Our company 401k plan took a 2-3% hit in 1 year, we made money the rest of the time so none of my employees took a big haircut with their 401k.

If I have 10 hours in a week I will spend it trying to sell, analyzing bids I lost, trying to find out why, and what GC's or developers are doing, not trying to determine economic trends locally. I don't care if XYZ corp decided not to expand until the next downturn, I just want to find the corp that is expanding, remodeling, opening new facilities or stores. By the time this information is in the news, its probably too late to be knocking on their door.

We all have limited resources, both economic and physical time, managing our time so we are making the best decisions is the best use of our time. We will probably get 75-85% of our decisions correct, the better we do, the less it costs us.

I spent a lot of time in business development classes learning how to focus on a limited set of problems and identifying the problems.

We start with a list of 100 or 200 things that need fixing in our business and we pick 8 or 10 and solve them, some we delegate, some aren't problems some are related to the bigger issues. People can own a job or a business. Its a choice.

My point is if members of this board are losing sales because their customers are moving to the sidelines and preserving capital, find the local markets that are moving forward and keep their business healthy.

The last recession is the first recession the brick and mortar stores didn't or couldn't expand / remodel.

We had contracts for about 15 stores in CA the we built and they went into storage because the landlords couldn't get funding to expand their malls or complete refresh so the stores that wanted to expand couldn't.

This message took way too much of my time so I don't want to get involved in a discussion of stats and why I am wrong or right, its just my beliefs and how I operate.

9/26/19 #50: You're welcome ...

Alan

Fair enough, and I have stated mine

I agree to disagree, I'm pretty sure that most of us don't have the resources of a consultant that you describe. And if we did would they beat a Vanguard index fund?

The intention of my original post was to take advantage of good times

You some how interpret that as wasting time.

Like I said I agree to disagree

9/26/19 #51: You're welcome ...

Pat,

Investment advisors work a sliding percentage (the more you have the less you pay). I think you need to have at least 50k.

We pay less than 1/2% at 50k probably 2%

What we want for the company 401k is someone that develops a plan, talks about when to change and makes recommendations when to move in and out of different equities and funds.

We probably buy and sell once or twice a year unless a stock we have or a fund hits a goal or and event that we previously discussed happens causes a sale.

I think even the smallest of shops should be maxing their contribution to a SEP IRA or 401k or whatever plan they have every year. Its more important for a small shop that isn't getting a paycheck with taxes and SS because that's their retirement.

Pay yourself first, then the government, then your vendors. Sell at a price that lets you do all that. The GC that we give a break to today won't be there to help us in 30 years by giving to our retirement fund.

Being fair to customers isn't denying your family or your future for their benefit.

Every year we get a report that shows how we did against different indexes and funds.

I think taking advantage of good times is important, it when we can sell at market price.

The discussion veered off to slumps and stats and a lot of local knowledge or disagreement.

What would you have done differently 10 years ago sold differently or invested differently.

I would think someone in there 40s should have a goal of at least 1 Million packed away for retirement more if they don't have much in SS, that lets you have about 37K a year on top of social security. The min 401k withdrawal is about .365 of assets if you are 70. The earlier you want to retire the more you need.

A-

9/28/19 #52: You're welcome ...

The worst recession in the last 100 years is coming, it will be worse than the dirty 30's.

There is way to much debt, and so much property is grossly over valued, companies are cutting back on wages and employees. there has to be a huge correction, it just can't maintain itself for much longer.

Anyways have a wonderful day, it is snowing here today so even more depressing.

9/28/19 #53: You're welcome ...

Scott that is the kind of thinking that got me thinking bad things were going to happen.

That is just not true, as I have explained in this thread.

11/26/19 #54: You're welcome ...

The sky is falling, run for cover. Err that was just a pigeon flying over. You have just as much chance of getting hit standing where you are as running around hollering the sky is falling.

The end is near, repent now. Or lets go to the bar and have a few while they are still available.

11/27/19 #55: You're welcome ...

There is an element of truth to the doom and gloomers especially after 2008.

Let's face it with the sort of debt the US has it is not going to end well.

But that is not going to be for a very long time.

BTW the debt is going to go to about 60-70 trillion by 2060, And it will not be a problem because the US has over a hundred trillion dollars in assets and will always pay their bill because the US owns the printing press. And the reserve currency status is not going to change.

11/27/19 #56: You're welcome ...

I keep hoping for another 2008. It allowed me to buy a nice property on the cheap & resell it two years later at a better profit than I could have ever made cutting up boards. I also bought some stocks at bargain levels that had continued to pay nice dividends. Keep some dry powder so you can take advantage of the opportunities. When the fools are selling it's time to buy. Just give them enough rope before you dive in. You have not lost one nickel when equities drop 20%, unless you sell. Doom and gloom has a shinny side.

11/29/19 #57: You're welcome ...

I hear you Larry.

But property can be hard to sell at times.

Not doom and gloom, but the reality is that's there are 140 major million homes that n the US. When boomers retire or die, it will leave a mark on housing prices. Outside of Tokyo probably prices in japan have begun to fall

|