Sorry for the formatting, this is from the ABA, forwarded by my banker.

You should ask you bank for an application otherwise go direct ot the SBA

A high level summary, take last years payroll, utilities, health insurance, payroll taxes, rent and divide x 12, then multiple by 2.5. (cap your wages at 100k) Thats the loan amount, you can apply for more but the 2.5x will be forgiven.

This is in addition to the loan from the other day. these loans are at .5% interest, two year term, whats not forgiven is due in two years

Subject: SBA - PPP Loans Update

ABA DAILY NEWSBYTES‌

ABA

BREAKING NEWS

Treasury Issues Guidelines, Application Form for SBA Paycheck Protection Program

Applications to Begin April 3

The Treasury Department today issued much-anticipated guidance for the Paycheck Protection Program, which starting this week will provide up to $350 billion in fully forgivable loans to help small businesses maintain payrolls during the coronavirus pandemic. The loans are fully guaranteed by the Small Business Administration, but the SBA will waive all SBA guaranty fees. PPP loans are made for two years at a 0.5% fixed rate with payments deferred for six months.

‌

All banks, as well as a broad range of nonbanks, are eligible to make PPP loans. Existing SBA-certified lenders will be given delegated authority; others must be approved before making loans. Banks that have not yet been certified with the SBA should submit an application to delegatedauthority@sba.gov. The SBA will quickly verify that banks applying are federally regulated, and new applicants will be able to process applications as soon as Friday, according to a senior administration official.

‌

To underwrite PPP loans, lenders will need to verify that the borrower was in operation on Feb. 15, 2020, and that it had employees for whom it paid salaries and payroll taxes. The lender will also have to verify the dollar amount of average payroll costs. The SBA will not review loan applications, according to a senior administration official, but lenders will receive an SBA loan number and verify that the applicant has not already received a PPP loan.

‌

The SBA will pay the lender a processing fee calculated on the loan balance, ranging from 1% for loans of over $2 million to 5% for loans of $350,000 or less. PPP loans may be sold in the secondary market, and the SBA will not collect fees for guarantees sold. The guidance includes fee caps for agents assisting with loan applications.

‌

Small businesses and sole proprietorships—generally, those with 500 or fewer employees—may apply for PPP loans starting on Friday, April 3; independent contractors and self-employed workers can apply starting April 10. PPP loans will be fully forgiven when used for payroll costs, interest on mortgages, rent and utilities, with at least three quarters of the forgiven amount being used for payroll; forgiveness is based on employers maintaining headcount or quickly rehiring and maintaining salary levels.

‌

PAYCHECK PROTECTION PROGRAM (PPP) INFORMATION SHEET:BORROWERSThe Paycheck Protection Program(“PPP”)authorizes up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis.All loanterms will be the same for everyone.The loan amounts will be forgiven as long as: The loan proceeds are used to cover payrollcosts, and most mortgage interest, rent, and utility costsover the 8 week period after the loan is made; andEmployee and compensationlevelsare maintained. Payrollcosts are capped at $100,000 on an annualized basis for eachemployee. Due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs.Loan payments will be deferred for 6months.When can I apply? StartingApril 3, 2020, small businesses and sole proprietorships can apply for and receive loans to cover their payroll and other certainexpensesthrough existing SBA lenders.StartingApril 10, 2020, independent contractors and self-employed individualscan apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders. Other regulated lenderswill be available to make these loansas soon as they are approved and enrolled in the program.Wherecan I apply?You can apply through any existing SBA lender or through anyfederally insured depository institution, federally insured credit union,and Farm Credit System institutionthat is participating. Other regulated lenders will be available to make these loans oncethey are approved and enrolled in the program. You should consult with your local lender as to whether it isparticipating. Visit www.sba.govfor a list of SBAlenders. Who can apply? All businesses–including nonprofits, veterans organizations, Tribal business concerns, sole proprietorships, self-employed individuals, and independent contractors–with 500 or fewer employees can apply. Businesses in certain industries can have more than 500 employees if they meet applicable SBA employee-based size standards for those industries (click HEREfor additional detail). For this program, the SBA’s affiliation standards are waived for small businesses (1) in the hoteland food services industries(click HEREfor NAICS code 72 to confirm);or (2) that are franchisesin the SBA’s Franchise Directory(click HEREto check); or(3) that receive financial assistance from small business investment companieslicensed by the SBA.Additional guidance may be released as appropriate.

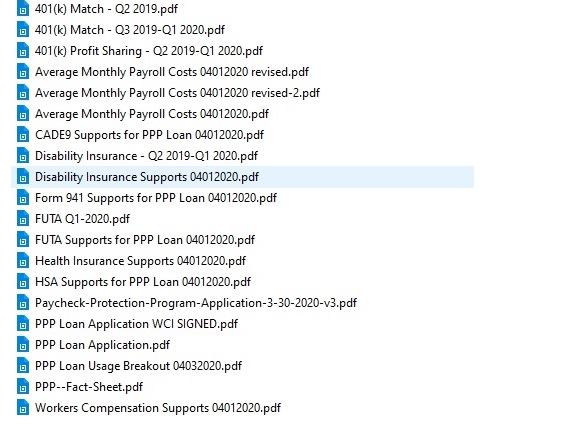

What do I need to apply? You will need tocomplete the Paycheck Protection Program loan application and submit the application with the required documentationto an approvedlenderthatis available to process your applicationby June 30, 2020. Click HEREforthe application.What other documents will I need to includein my application?You will need to provide your lender with payroll documentation.Do I need to first look for other funds before applying to this program? No. We are waiving the usual SBA requirement that you try to obtain some or all of the loan funds from other sources (i.e.,we are waivingthe Credit Elsewhere requirement).How long will this program last?Although the program isopenuntil June 30, 2020, we encourage you to apply as quickly as you can because there isa funding capand lenders need time to processyour loan.How many loans can I take out under this program?Only one. What can I use these loans for? You shoulduse the proceedsfrom these loansonyour:Payroll costs, including benefits;Interest on mortgageobligations, incurred before February 15, 2020; Rent,under lease agreements in force before February 15, 2020;and Utilities,for which service began before February 15, 2020.What counts as payroll costs?Payroll costs include:Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for eachemployee);Employee benefits including costs forvacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; andpayment of any retirement benefit;State and local taxes assessed on compensation;and For a sole proprietoror independent contractor: wages, commissions, income, or net earnings from self-employment, capped at$100,000on an annualized basisfor each employee.How largecan my loan be? Loans can be forup to two months of youraverage monthly payroll costsfrom the lastyearplus an additional 25% of that amount. That amount issubject to a$10 millioncap. If you are a seasonal ornew business, youwill use differentapplicabletime periodsfor yourcalculation. Payroll costswill be capped at$100,000 annualized for eachemployee. How much of my loan will be forgiven? You will owe money when your loan is due if you use theloan amount for anythingother than payroll costs, mortgage interest, rent, and utilities payments over the 8 weeks after getting the loan. Due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs. You will also owe money if you do not maintain your staff and payroll.

Number of Staff: Your loan forgiveness will be reduced if youdecrease yourfull-timeemployeeheadcount.Level of Payroll: Your loan forgiveness will also be reduced if youdecrease salaries and wages by more than25%for any employee that made less than $100,000 annualized in 2019. Re-Hiring: You haveuntil June 30, 2020 to restoreyourfull-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020. How can I request loan forgiveness?You can submit a requestto the lender that is servicing the loan. The requestwillincludedocuments that verifythe number of full-time equivalent employees and pay rates,as well as the payments on eligible mortgage, lease, and utility obligations. You must certify that the documents are true and that you used the forgiveness amount to keepemployees and make eligible mortgage interest, rent, and utility payments.The lender must make a decision on the forgivenesswithin 60 days.What is my interest rate?0.50% fixedrate.When do I need to start paying interest on my loan? All payments are deferred for 6 months; however, interest will continue to accrue over this period.When is my loan due? In2years.Can I pay my loan earlier than 2years?Yes. There are no prepayment penalties or fees. Do I need to pledge any collateral for these loans? No. No collateral is required.Do I need to personally guarantee this loan? No. There is no personal guarantee requirement. ***However, if the proceeds are used for fraudulent purposes, the U.S. governmentwill pursue criminal chargesagainst you.***What do I need to certify? As part of your application, you need to certify in good faiththat:Current economic uncertainty makes the loan necessary to support your ongoing operations.The funds will be used to retain workers and maintain payroll or to make mortgage, lease, and utility payments.You have not and will not receive another loan under this program.You will provide to the lender documentation that verifiesthe number of full-time equivalent employees on payroll andthe dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities for the eight weeks after gettingthis loan.Loan forgiveness will be provided for the sum of documented payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities. Due to likely high subscription, it is anticipated that notmore than 25% of the forgiven amount maybe for non-payroll costs.All the information you provided in your application and in all supporting documents and forms is true and accurate. Knowingly making a false statement to get a loan under this program is punishable by law.

You acknowledge that the lender will calculate the eligible loan amount usingthetax documents yousubmitted. Youaffirm that the tax documents are identical to those yousubmitted to the IRS. And youalso understand, acknowledge,and agree that the lender can share the tax information with the SBA’s authorized representatives, including authorized representatives of the SBA Office of Inspector General, for the purpose of compliance with SBA Loan Program Requirements and all SBA reviews.